Crypto and Real Estate: The Future of Home Financing is Around the Corner

Big news for anyone holding crypto and dreaming of homeownership: The mortgage world just got a major crypto upgrade. Federal regulators have told Fannie Mae and Freddie Mac – the huge players behind about half of all U.S. home loans – to start counting your cryptocurrency holdings when you apply for a mortgage.

This is a game-changer. For too long, crypto holders faced a dilemma: sell your digital assets to qualify for a loan, or hold onto them and potentially struggle to get that mortgage. Well, those days are changing!

Here's a breakdown of what's happening, why it's a big deal, and what you should know if you're eyeing a home with crypto in your portfolio.

Crypto as a Real Asset (for Mortgages)

On June 25, 2025, William Pulte, director of the Federal Housing Finance Agency (FHFA), made it official. His directive is clear: Fannie Mae and Freddie Mac need to figure out how to count your crypto as a qualifying asset when they assess mortgage risk.

The new policy has some key points:

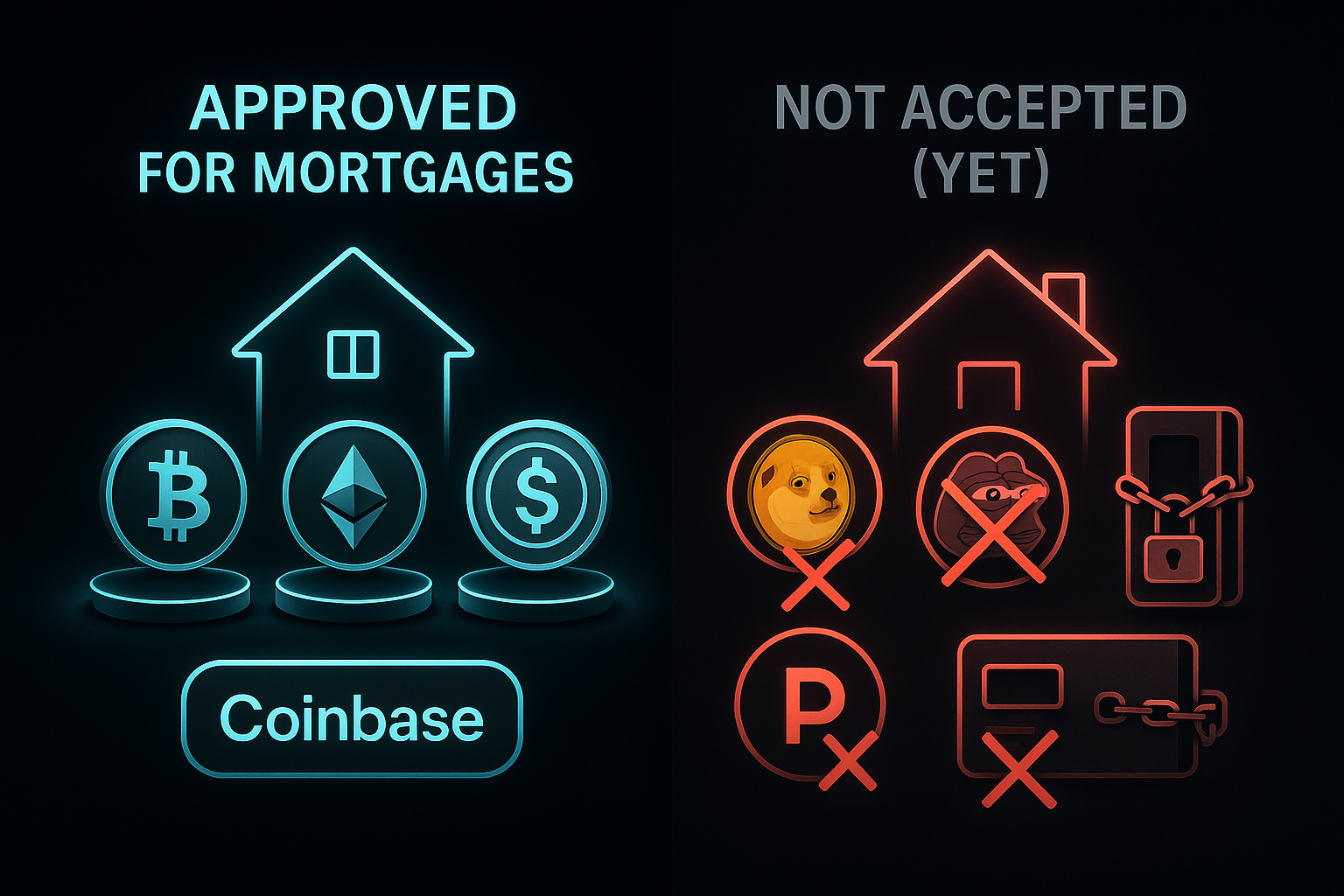

- Only crypto on U.S.-regulated centralized exchanges will count. Sorry, self-custody fans, your personal wallet won't cut it for now.

- No need to convert to dollars first. This is huge – you won't be forced to sell your crypto just to apply.

- The agencies must develop their risk assessment plans "as soon as reasonably practical."

This is a stark contrast to how things used to work, where lenders basically said, "Sell your crypto, then we'll talk."

Why This Matters for Crypto Holders

Before this, you had that tough choice: liquidate your crypto for cash to show liquid funds, or keep your assets and maybe miss out on a loan. As Daryl Fairweather, chief economist at Redfin, puts it, "This is a big win for advocates of cryptocurrencies who want crypto to be treated the same way as other assets are."

It's a clear signal: cryptocurrency isn't just a speculative novelty anymore; it's a legitimate asset class. With Bitcoin hitting new highs and big institutions jumping in, regulators are finally catching up to what many crypto owners already knew – digital assets deserve the same respect as traditional investments.

Opening Doors to Homeownership

The whole point of this policy is to help more people qualify for mortgages by broadening how lenders look at your assets. Think of it this way: stocks and bonds already count toward the reserves lenders like to see. Now, crypto joins that list.

"If Fannie and Freddie are going to accept cryptocurrency as collateral, that's a strong incentive for banks to shift their practices," explained Danielle Hale, chief economist at Realtor.com. "People who might otherwise have to sell cryptocurrency to qualify… under this new policy, they can qualify."

This couldn't come at a better time, especially with recent housing market challenges. High mortgage rates and rising prices have kept many potential buyers on the sidelines. This new approach offers a fresh path forward.

Volatility? They've Got It Covered.

No one's ignoring crypto's famous price swings. Lenders already "discount" volatile assets like individual stocks, and they'll do the same with crypto. "As long as lenders are appropriately discounting crypto based on volatility, it's fine that crypto investments count toward reserves," Fairweather noted.

So, your Bitcoin or Ethereum might not count dollar-for-dollar. Lenders will likely apply a "haircut," valuing your crypto a bit lower to account for potential price dips. It's about being realistic, not eliminating risk entirely.

What About "Self-Custody"?

One detail might irk crypto purists: the rule specifically says your crypto must be "stored on a U.S.-regulated centralized exchange." This means crypto in your personal wallet or a hardware device (that's "self-custody" in crypto-speak) won't qualify.

Why the restriction? Regulators want transparency and easy verification. Centralized exchanges provide clear records that mortgage underwriters can easily check. It's a trade-off for mainstream adoption.

What's Next & How to Get Ready

There's no exact timeline yet for when these changes kick in. Fannie and Freddie have to put together their proposals "as soon as reasonably practical," but getting new mortgage guidelines in place will take some time. Banks will need to update their systems, train staff, and create new ways to verify crypto assets.

If you're a crypto holder thinking about buying a home, here's how to prepare:

- Keep it on a Regulated Exchange: Make sure your crypto is on a U.S.-compliant exchange (Coinbase, Gemini, etc.).

- Track Everything: Keep good records of your investments – when you bought, how much, and what it's currently worth.

- Expect a "Haircut": Understand that lenders will likely discount your crypto's value due to market volatility.

- Timing is Key: Always consider current crypto and housing market conditions when planning your purchase.

A New Chapter for Crypto (and Homebuyers)

This isn't just a policy tweak; it's official recognition that digital assets are part of mainstream finance. For crypto holders, it means fewer roadblocks between your digital investments and big life goals. For the wider market, it signals continued institutional adoption and regulatory acceptance.

The housing market is always changing, and this new tool helps qualified buyers get into homes. Whether it supercharges home sales remains to be seen, but it definitely opens up options for crypto-savvy buyers.

As the details roll out and lenders adapt, we'll get a clearer picture of how this plays out. But for now, crypto holders can celebrate a huge step toward financial legitimacy – and maybe start that house-hunting process they've been putting off!