XRP's Resurgence: ISO 20022 Propels It Past All-Time High!

The crypto market continues its explosive run, with Bitcoin cruising above $119K and Ethereum solidifying its position over $3K. But today, the spotlight is firmly on XRP, which has surged nearly 16% in 24 hours, now breaking it's all time high and moving upwards of $3.50. These movements signify a major global shift in finance, and XRP may be perfectly positioned to ride them.

The Game-Changer: ISO 20022 Adoption

What's really fueling XRP's impressive climb? One major impact is the ongoing global shift to the ISO 20022 messaging standard.

- What is ISO 20022? It's a universal messaging standard for financial institutions, designed to replace older, less efficient systems (like SWIFT's MT messages). Think of it as upgrading the global financial language to a richer, more structured, and more data-rich format. This allows for faster, more transparent, and more efficient cross-border payments and financial transactions.

- Why Now? Just recently, on July 14th, the U.S. Federal Reserve's Fedwire (its real-time gross settlement system) officially completed its transition to ISO 20022. This is a monumental step, following similar adoptions by major payment systems globally.

XRP's Strategic Alignment: A Perfect Fit for the New Standard

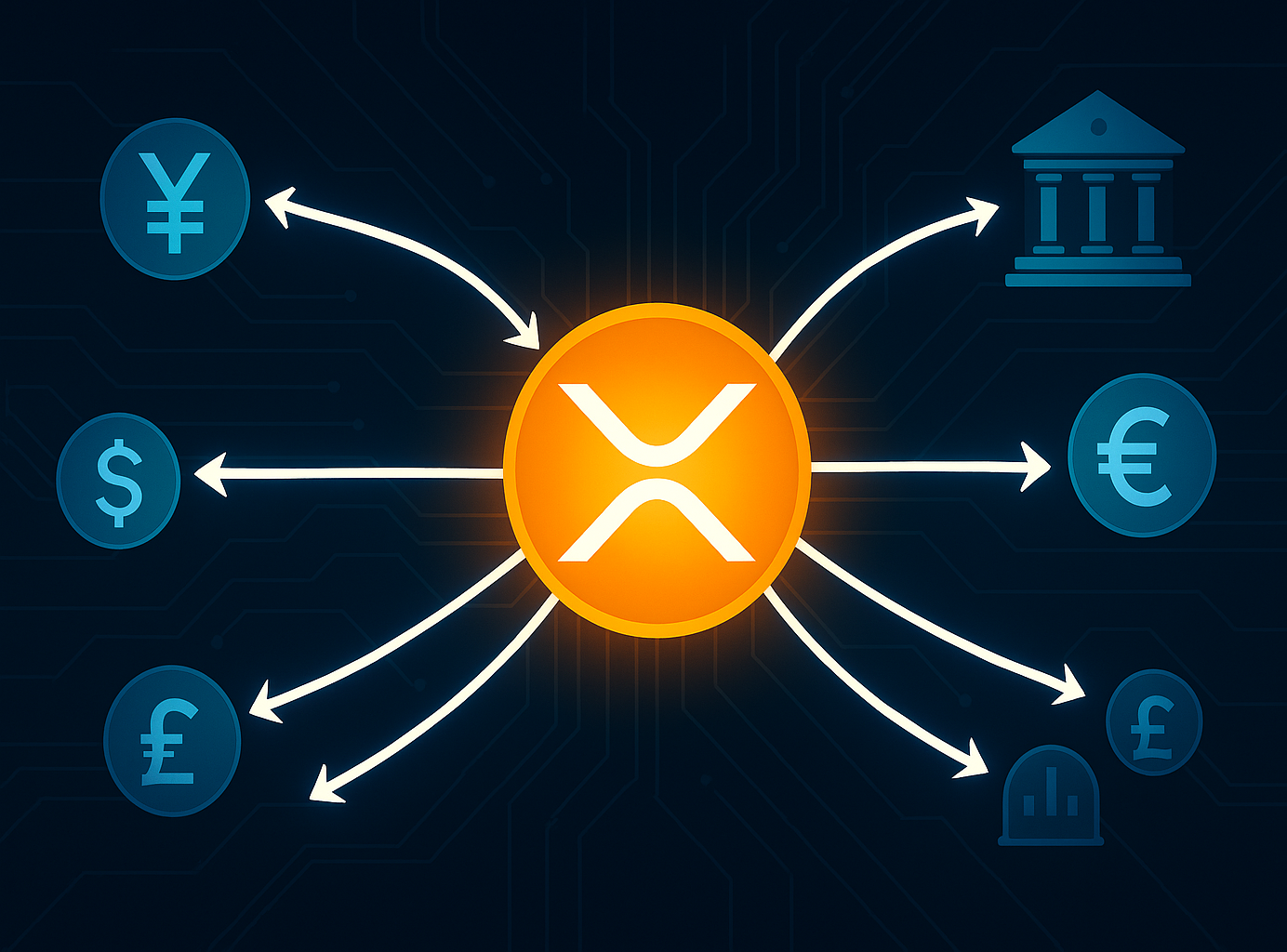

This is where XRP comes into play. XRP, and the broader Ripple ecosystem, were essentially built with the principles of ISO 20022 in mind:

- Efficiency & Speed: XRP's underlying technology, the XRP Ledger, is designed for incredibly fast (3-5 second finality) and low-cost international transactions. This aligns with the goals of ISO 20022 to streamline global payments.

- Interoperability: As more financial institutions adopt ISO 20022, the need for seamless, interoperable payment solutions becomes paramount. XRP's role as a bridge currency that can instantly settle transactions between different fiat currencies (or even other digital assets) becomes highly attractive.

- Institutional Readiness: While not directly mandated by ISO 20022, many "ISO 20022 compliant cryptocurrencies" (including XRP, XLM, ADA, ALGO, QNT, HBAR) are being eyed by banks and payment systems looking for robust, programmable settlement options. XRP's long-standing focus on institutional adoption positions it strongly in this environment.

Broader Market Tailwind: Altcoin Momentum & Positive Sentiment

It's important to note that XRP is not alone in it's sudden rise. It's riding the wave of what people are starting to accept is a bullish market:

- Bitcoin's Dominance: BTC's consistent new highs and massive ETF inflows are creating a strong foundation of confidence across the crypto market.

- Altcoin Momentum: As Bitcoin and Ethereum lead the charge, capital tends to flow into well-positioned altcoins, with traders looking for assets with strong fundamentals and upside potential.

What to Watch Next

- Sustaining the New ATH: The key now is whether XRP can consolidate above its new all-time high and establish new support levels.

- Continued ISO 20022 Adoption: Keep an eye on other major payment systems globally making their full transition.

- Ripple's Partnerships: Any new announcements from Ripple (the company behind XRP) regarding institutional partnerships or use cases will be significant.

Ethos Insight: Understand the Fundamentals Behind the Surge

While price action is exciting, XRP's current momentum offers a crucial lesson: fundamental technological shifts and institutional adoption can be powerful long-term drivers.

- Look Beyond the Hype: Understand the underlying utility and strategic positioning of assets like XRP.

- Diversify Strategically: Consider assets that align with major technological and regulatory trends in traditional finance.

- Stay Informed: Keep track of global financial standard adoptions – they have real-world implications for crypto.

Download the Ethos app today and stay on top of both market trends and critical shifts in global finance!